When you have a bunch of debts and you are tired of the calls and letters and increasing balances, Debt Management Plan (DMP) may be a feasible, informal way of getting it all under control. A DMP is a popular debt management plan UK solution to individuals with unsecured debts like, credit cards, personal loans, overdrafts and store cards, who can afford to make a few regular payments but require a one, manageable monthly payment. This page describes what a DMP is, its operation, qualification, possible cost, impact on your credit history and the practical alternatives so that you can select the optimal debt remedy to your situation.

In case you want a next step, which is fast, you can begin with a free, confidential evaluation and clarify the reason a DMP or another alternative is better. Contact us any time.

What Is a Debt Management Plan (DMP)?

A Debt Management Plan (DMP) is an unofficial agreement between you and your unsecured creditors where you make one agreed monthly payment which is shared out amongst your lenders. It is targeted at those UK residents that have several unsecured debts and can afford to pay a bit every month but are finding it hard to make numerous minimum payments and maintain household payments.

Key points at a glance:

A DMP has been described as a pragmatic method of trying to bring together the payments without the need to borrow money or go into a formal insolvency. It is most effective in the case when the main concern of people is preventing the growth of interest, getting out of stress caused by numerous creditors and paying one small payment monthly they can afford.

How Does a Debt Management Plan Work?

A DMP should be straightforward and transparent. The objective is to calculate what you can realistically afford, present that to your creditors and then manage the distribution of payments so you only need to make one monthly contribution.

Typical DMP process — step by step:

This informal, case-by-case approach is the reason many people choose a DMP as an accessible debt management option in the UK. It is practical for managing unsecured debts while protecting household essentials and avoiding formal insolvency where possible.

What Debts Can and Can’t Be Included?

Understanding which debts a DMP can cover is key to setting realistic expectations.

Which debts can normally be included:

Which debts usually cannot be included (or are handled separately):

A DMP is designed for unsecured debts; if your primary problems relate to priority liabilities or you require debt write-off, other solutions such as an IVA or formal insolvency may be more suitable. We will explain this clearly during your assessment. See our IVA page for contexts where write-off may be necessary.

Who Is a DMP Suitable For?

A DMP is a valuable option for many, but it is not the right path for everyone. The suitability depends on income, the balance between essential spending and available surplus, and whether your debts are primarily unsecured.

Typical situations where a DMP helps

When a DMP might not be right

Assessing DMP eligibility is therefore an essential first step. We help you determine if a DMP will realistically clear your debts without creating new hazards and explain alternatives where necessary.

- You need immediate debt write-off because your debts are unmanageable; in such cases an IVA might be considered.

- You have significant secured debts where the home is at risk and a secured consolidation solution is being considered; debt consolidation vs DMP is a decision we can help you weigh.

- Your creditors have already started legal enforcement (County Court Judgments or charging orders); some formal routes may be required.

How Much Will You Pay Each Month?

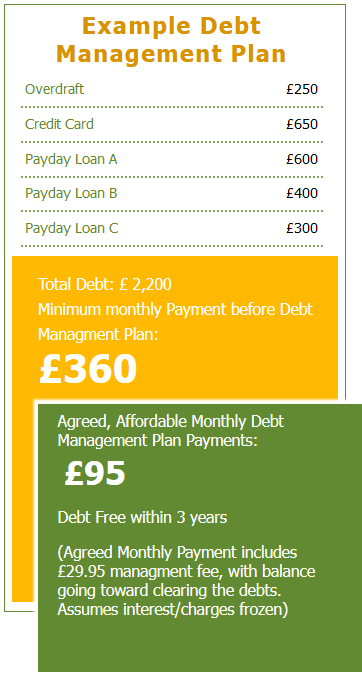

Success is based on affordability. An example of a snapshot to illustrate the mechanics before-after is provided below. These are just sample figures to be explained; your plan will vary depending on your income and expenditure and the response of your creditors.

Before and after a DMP

If a creditor records missed payments before a DMP is agreed, those defaults remain on your credit file; entering a DMP may see new notations that lenders can view, which affects the credit report. We will explain likely credit file impacts during your assessment.

A DMP does not automatically guarantee frozen interest. Creditors often agree to freeze or reduce interest and charges when they accept payments through a reputable plan administrator, but each creditor decides individually and there is no statutory obligation. We always negotiate on your behalf and record any concessions.

| Category | Before DMP (monthly totals) | After DMP (monthly totals) |

| Total unsecured debt | £6,500 across 6 creditors | £6,500 (unchanged) |

| Monthly minimum payments | £420 | Single affordable payment: £150 |

| Interest & charges | High; balances increasing | Creditors may agree to freeze or reduce interest & charges |

| Calls & letters | Regular, stressful | Reduced once creditors accept the arrangement |

| Timeframe (approx.) | Uncertain; could increase if only paying minimums | Dependent on payment and interest concessions; typically several years |

The aim of a DMP is to make monthly payments realistic while trying to halt interest creep and reduce the time it takes to clear debt where possible.

Pros and Cons of a Debt Management Plan

A balanced, transparent comparison of pros and cons is essential before you commit. We walk through these with you and explain how the DMP compares to alternatives such as an IVA or a secured consolidation loan.

No solution is perfect; a DMP has clear advantages and some drawbacks that you should weigh carefully.

Benefits of a DMP

Risks and downsides

How a DMP Affects Your Credit Score and Future Borrowing

A DMP usually appears on credit reports because it represents an agreed change to repayment terms. Typical effects include:

It’s important to balance the short-term effect on your credit file against the longer-term benefit of reducing or clearing debt and avoiding forced enforcement. If you require mortgage advice or are concerned about remortgaging possibilities, we discuss realistic timelines and whether a DMP will prevent mortgage applications; in some cases, formal solutions are treated differently by mortgage underwriters. We will explain the likely path based on your goals.

Alternatives to a Debt Management Plan

One of the debt solutions is a DMP. The following are brief outlines of typical substitutes, when they are potentially suitable, and their main compromises.

IVA — when you need some of your debt written off

Individual Voluntary Arrangement is a written and binding agreement which can include partial write-offs of debt and has an average five year period. An IVA is a stronger one where you are unable to control your debts and requirements and must be written off, it possesses long term credit consequences but has the ability to provide a definite setting in the event it is approved by creditors.

Debt consolidation loan / secured loans

A consolidation loan involves a replacement of a number of unsecured debts by a single debt that may be easier to pay and may lead to cheaper monthly payments based on the rates. Secured homeowner loan or property equity can reduce the rates at the expense of your house in case of default. Consolidation is a good fit to homeowners who have a consistent repayment capacity and are aware of the secured risks.

Full and final settlement

A full and final settlement is a negotiation to pay a creditor a lower sum of money in lump-sum to settle a debt. It may be efficient when a lump sum is available to you, but tends to place a mark on your credit record and might not be accepted by all lenders.

The correct option would be based on your objectives, resources and the need to write off or some legal security or just a breathing space to stabilise finances. We evaluate other paths and bring objective comparisons to your situation.

How to Start a Debt Management Plan with Money Debt & Credit

Starting a DMP is straightforward when you have reputable, FCA-aware support. Our process focuses on clear information and realistic commitments:

If you are ready to discuss options, start the conversation by contacting us.

Debt Management Plan FAQs

Ready to Explore Your Options?

A DMP can be a simple, practical route to regain control over unsecured debts without entering formal insolvency. But it is essential to have a realistic picture: the plan should fit your household budget, protect priority debts and be agreed with creditors wherever possible. We provide confidential, non-judgmental debt help in the UK, a clear affordability assessment and honest comparisons between DMPs, IVAs, consolidation loans and settlement options.

If you’d like a personalised appraisal of whether a DMP is right for you, contact us for a free assessment and step-by-step support.