Money Debt & Credit is a company that collaborates with FCA-licensed partners to provide debt remedies and regulated guidance. Our IVA services are confidential and non-judgmental, with licensed insolvency practitioners and knowledgeable advisers to help you know whether an IVA is the right path to take and what to expect at each stage.

The following guide defines what an IVA is, how it operates in the UK, who can use it, the calculation of payments, the effects on your credit file, and other options you should take. It is addressed to individuals with a number of unsecured debts and requires a legally binding and long-term resolution, or simply seeks to know how an IVA compares with other debt relief solutions like DMPs, bankruptcy, or settlement.

What Is an IVA? (Individual Voluntary Arrangement)

An IVA (Individual Voluntary Arrangement) is a legally binding agreement between you and your creditors that lets you pay back what you can afford over an agreed period — commonly five years — after which any remaining unsecured debts included in the IVA are written off. An IVA is arranged and overseen by a licensed Insolvency Practitioner (IP) who prepares a proposal for your creditors. If the proposal is approved (typically by at least 75% of creditors by value), the arrangement becomes binding on all creditors who were invited to vote.

Key short facts:

An IVA is different from informal solutions (like a DMP) because it provides legal protection once approved — creditors included in the arrangement cannot pursue you for the included debts while the IVA runs.

How Does an IVA Work? (Step-by-Step)

Below is a clear, step-by-step outline of how an IVA is typically set up and managed in England, Wales, and Northern Ireland.

What Debts Can Be Included in an IVA?

IVAs are primarily for unsecured debts, but the precise list of includable and excluded debts matters:

Typical debts you can include:

Debts usually excluded or treated differently:

Priority debts (mortgage arrears, rent, council tax, utility arrears) may require separate handling; an IVA can still be used in parallel but priority payments must usually continue. Always check with an adviser how priority liabilities will be managed alongside an IVA.

Who Qualifies for an IVA? (Eligibility Requirements)

An IVA is not available to everyone; typical eligibility criteria focus on debt levels, income stability and the number of creditors.

Minimum debt level

There is no strict statutory minimum, but IVAs are generally considered when total unsecured liabilities are at a meaningful level — commonly around £6,000–£8,000 or more, and often used by people with debts substantially above that level. Many providers and advisers use thresholds in that range to identify viable IVA cases.

Stable income

You must normally have sufficient, regular income (wages, benefits or pension) to make the proposed monthly payments over the IVA term (commonly 60 months). The IP and adviser will calculate your disposable income after priority household bills and essential spending to set payments.

Multiple creditors

IVAs are often most suitable where you owe money to multiple creditors and a single legally binding solution will simplify payments and stop creditor action. The presence of several unsecured accounts strengthens the case for an IVA.

Residency and jurisdiction

IVAs are available to residents of England, Wales and Northern Ireland. Scotland has different insolvency routes (for example, Protected Trust Deeds).

If you meet these basic criteria, an initial assessment will focus on the detailed income & expenditure assessment to test affordability and the likely creditor outcome.

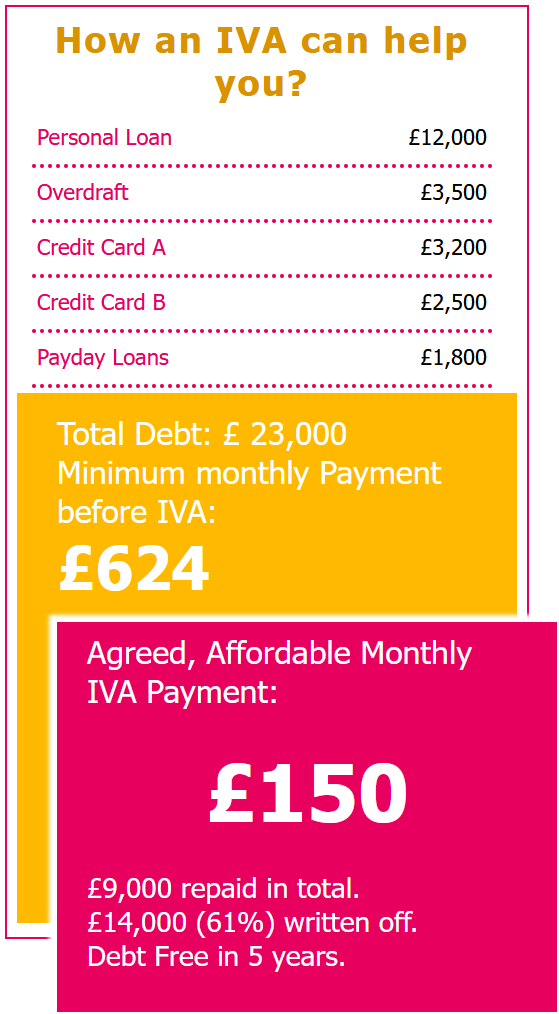

How Much Debt Can Be Written Off in an IVA?

One of the key attractions of an IVA is debt write-off: at the end of the IVA any remaining included unsecured debts are discharged. How much is written off depends on what creditors are expected to receive through the IVA compared with other options.

An IVA is therefore a negotiated debt relief option: it provides certainty about a final write-off once the agreed payments are completed.

Monthly Payments in an IVA

Payments are the backbone of an IVA. Understanding how they are calculated and what happens if your income changes is essential.

How payments are calculated

Your Insolvency Practitioner will prepare an income and expenditure statement that shows gross income, essential household bills, priority debt payments and reasonable living costs.

Disposable income — the surplus left after essentials — forms the basis for the monthly IVA payment. The IP will propose how much of that surplus is paid to creditors each month.

Disposable income and household budget

The IVA aims to be affordable. Both StepChange and other providers make clear that payments are set at a level that allows you to live while contributing to the plan; annual reviews ensure payments remain sustainable.

What happens if income changes

IVAs normally include provision for reviews. If your income falls or essential costs rise, you should inform the IP immediately; payments may be reduced or the IVA varied where appropriate. Conversely, if your income increases significantly, you may be expected to pay more or make a surplus contribution. Failure to keep payments up can lead to an IVA failing and potential creditor action, including bankruptcy.

| Item | Monthly figure (example) |

| Gross income | £1,900 |

| Essential household bills & priority payments | £1,200 |

| Reasonable living expenses | £300 |

| Disposable income available | £400 |

| Proposed IVA monthly payment (example) | £300 |

| Remaining buffer (savings/contingency) | £100 |

IVA Pros and Cons

Weighing the benefits and risks will help you decide whether an IVA is appropriate.

Benefits of an IVA

Risks and downsides

A reputable adviser will clearly set out these pros and cons and compare the IVA with alternatives like a DMP, bankruptcy, Debt Relief Order (DRO) or settlement offers.

How an IVA Affects Your Credit Score

Defaults and credit file entries

Any defaults logged before the IVA remain on your credit file. The IVA itself is recorded and visible to lenders. This can reduce access to credit while it remains on record.

IVA stays on file for 6 years

An IVA is usually shown on your credit file and on the Insolvency Register for the duration of the IVA; typical guidance is that the IVA will affect your credit rating for six years from the start of the arrangement (or from the date of insolvency registration).

Rebuilding credit after an IVA

After completion and write-off, you can begin rebuilding your credit profile by demonstrating stable finances and sensible use of limited credit products. Many people find that, despite short-term impact, completing an IVA provides a clearer long-term recovery path than ongoing defaults or bankruptcy. Advisers can suggest realistic timelines and steps for rebuilding.

IVA and Your Home, Car and Assets

Your assets are considered in the IVA proposal because they affect what creditors can reasonably expect to recover.

An IVA does not automatically force sale of your home, but equity and the realistic returns to creditors are part of the negotiation and can influence the terms and payments.

IVA vs Other Debt Solutions

You should compare an IVA with alternative debt relief options to choose the best path.

IVA vs DMP

An IVA is formal and legally binding; a DMP is informal. IVAs can include write-off and legal protection; DMPs are more flexible and less intrusive but cannot guarantee write-off or legal protection. Choose DMPs where you can afford realistic monthly payments without needing write-off.

IVA vs Bankruptcy

Bankruptcy is a court process with different severe legal consequences and effects on assets. An IVA is often chosen to avoid bankruptcy while achieving a structured write-off and protecting essential assets where possible. Bankruptcy may be quicker in some circumstances but carries significant restrictions.

IVA vs Debt Relief Order (DRO)

A DRO is for people with low debts and very limited assets; it is available in specific circumstances and is quicker and cheaper but has strict eligibility. IVAs suit higher debts and people with regular disposable income.

IVA vs Full & Final Settlement

A full & final settlement clears a particular debt for a reduced lump sum. It can be effective where you have a lump sum, but it clears specific accounts and may not address multiple creditors comprehensively.

How to Start an IVA with Money Debt & Credit

If you think an IVA may be right for you, our process is straightforward and supportive:

If you want to explore an IVA, contact us. We will explain the IVA process step by step and give an honest appraisal of likely outcomes.

IVA FAQs

Find Out If an IVA Is Right for You

IVA can provide a clear, legally binding route to debt relief and write-off to lots of people with high levels of unsecured debts but it is an extreme undertaking with credit and asset consequences. We have partners who are FCA-authorised and licenced insolvency practitioners to provide you with honest and transparent advice and to take you through the IVA process step by step. To find out which way is most effective, then begin with a free, confidential analysis so that we can see the IVAs, DMPs, settlements and other forms of debt relief that best fit your situation.